Velocity of Money: What it Means to You

As we all know, the global economy has seen a significant tightening over the past two months. Consequently, this has led to a slowdown in a metric known as the Velocity of Money, or the rate at which money exchanges hands through the various transactions that make up an economy. The faster money trades hands, the healthier the economy in question is assumed to be. It is calculated as the economy’s GDP divided by its money supply.

I’d like to borrow this concept from its macroeconomics base and apply it on a more micro level – each person. If we can understand how the Velocity of Money applies on an individual level, we will understand – in theory – the quickest way to building substantial wealth through investments.

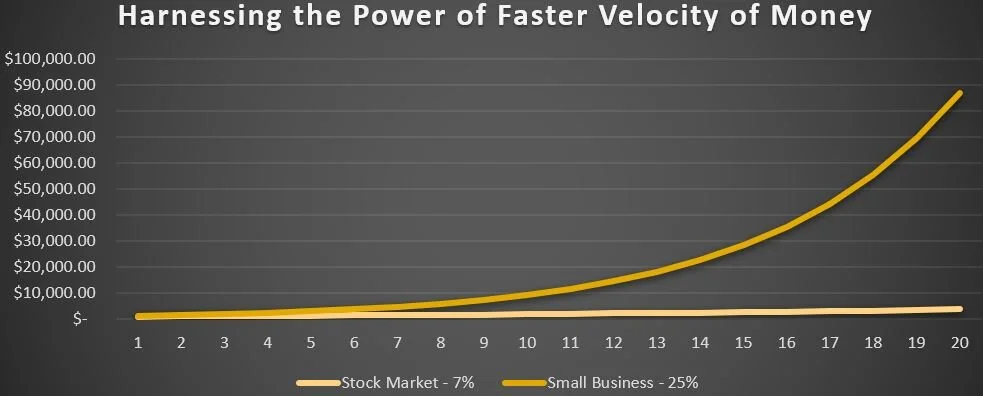

Let’s say a person invests $1,000 into the stock market, which returns on average 7% annually. That means it would take around 10 years for his $1,000 to double. At that point, he can sell half of his shares, keep $1,000 of profit working for him in the stock market, and then invest his initial principal somewhere else. That is the Velocity of Money working for him, albeit not very quickly.

Now, imagine someone invests their money in a local small business that will grow at 25% a year. Her $1,000 will double after only 4 years. At that point, she can sell half of her shares and invest $1,000 in another, higher-flying business while still keeping an ownership of $1,000 in the first investment. Over the following 4 years (years 5-8 if you’re counting), she will have $2,000 grow into $4,000. Or, her initial $1,000 turned into $4,000 in only 8 years, as compared to the stock market index guy above, whose $1,000 turned into $2,000 in 10 years.

This, in all its simplicity, is the importance of understanding the Velocity of Money. How fast will your money come back to you? And when it does, be sure to put it back to work so it comes back even faster next time.

If some semblance of this analysis is not in your investment selection thought process, or if you’re not investing at all, right now is the perfect time for you to reevaluate your financial goals and what they may project for your future.